Car Insurance Rates

Detail of Car Insurance Rates

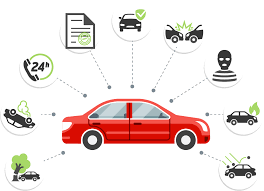

When you own an older car, finding the best car insurance rates can be tricky. While newer cars often come with higher insurance costs due to their higher value, older cars may have different needs. You might want to save on premiums, but still protect your car from unexpected events like accidents, theft, or weather damage. Fortunately, there are ways to find affordable car insurance for older cars without compromising on coverage.

In this article, we’ll guide you through how to get the best car insurance rates for older vehicles.

Why Are Car Insurance Rates Higher for Newer Cars?

Before we dive into finding the best Car insurance rates for older cars, it’s important to understand why newer cars often come with higher insurance premiums. The main reason is that newer cars have a higher market value. This means if your car is damaged or stolen, the insurance company will need to pay out more money to replace it or repair it.

In contrast, older cars have a lower value, so the risk for insurance companies is smaller. However, older cars might have more wear and tear, making them potentially more expensive to repair. That’s why insurance for older cars can vary widely depending on the type of coverage you choose.

What Type of Insurance Do You Need for an Older Car?

When insuring an older car, it’s important to consider the right type of coverage. The most common types of car insurance are:

- Liability Coverage: Best Car Insurance Rates is the basic coverage required in most states. It covers damages or injuries you cause to others in an accident. It doesn’t cover damage to your car, making it cheaper but less comprehensive.

- Collision Coverage: This covers damage to your own car after an accident, regardless of who is at fault. However, if your car has a very low value, it may not make sense to pay for collision coverage as it might cost more than the car is worth.

- Comprehensive Coverage: This covers damages from things like theft, vandalism, or weather events. If your older car is valuable to you, it may be worth considering comprehensive coverage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re in an accident with someone who doesn’t have insurance or doesn’t have enough insurance to cover the damage.

For older cars, many drivers choose to skip collision coverage or comprehensive coverage if the car is worth less than the deductible or policy costs. This helps save on premiums. However, if your car still has sentimental or practical value, maintaining full coverage may be a good choice.

Tips for Getting the Best Insurance for Older Cars

Here are some simple tips to help you get the best car insurance rates for your older car:

- Shop Around: Rates can vary significantly between insurance providers, so it’s important to get quotes from multiple companies. Comparing rates will help you find the most affordable option.

- Choose the Right Coverage: Consider only the coverage you really need. If your car is older and its value is low, it might not be worth paying for collision or comprehensive coverage. Opt for liability coverage or basic protection instead.

- Increase Your Deductible: Raising your deductible can lower your monthly premiums. Just make sure you choose a deductible amount you can afford if you need to file a claim.

- Look for Discounts: Many insurance companies offer discounts that can lower your premiums. These may include discounts for bundling multiple policies, having a clean driving record, or driving fewer miles each year.

- Consider Usage-Based Insurance: Some insurers offer pay-per-mile insurance or usage-based insurance. If you don’t drive your older car very often, this could save you money to get low Car Insurance Rates, as you’ll only pay for the miles you drive.

- Maintain a Good Driving Record: A clean driving record can help you qualify for lower rates, even on older cars. Avoid accidents and traffic violations to keep your insurance premiums as low as possible.

- Check for Low Mileage Discounts: If you don’t drive your older car much, some insurers may offer a discount for low mileage. Be sure to ask about this option when getting quotes.

Where to Look for the Best Car Insurance Rates

Some car insurance companies are known for offering competitive rates on older cars. Here are a few popular options to consider:

- Geico: Known for its competitive rates, Geico often provides discounts for safe driving and bundling policies, which could help reduce premiums for older cars.

- State Farm: State Farm offers a variety of options for older cars, including low-mileage discounts and flexible coverage choices.

- Progressive: Progressive offers great options for older car insurance, including discounts for bundling home and auto insurance and a large selection of policy options.

- Allstate: Allstate provides affordable options for older cars, and their online tools can help you find discounts for safe driving and good vehicle maintenance.

- Esurance: Esurance, an online-only insurer, can offer some of the best rates for older cars, especially for those with a good driving history.

Conclusion

Finding the best car insurance rates for older cars is all about understanding your car’s value, selecting the right coverage, and shopping around for the best deal. By adjusting your coverage to suit your car’s needs and taking advantage of available discounts, you can keep your insurance premiums low while ensuring you’re properly protected.

Remember, the key to saving on car insurance is to tailor your policy to match the value and use of your older car. By following these simple steps, you’ll be able to find an affordable insurance plan that works for you and your vehicle.